Closing down an office and managing the transition can sometimes be daunting. Office liquidation involves systematically closing an office, selling or disposing of assets, and managing the transition for employees and stakeholders. This process can be necessary due to downsizing, relocation, or closure. A well-executed liquidation minimizes disruptions and maximizes asset value.

Office liquidation helps businesses recover investments by selling valuable assets and ensures a smoother transition with reduced downtime. Proper disposal and recycling of office equipment minimize environmental impact, and adhering to legal requirements avoids potential fines and legal issues.

Preparing for Office Liquidation

Before proceeding with the liquidation process, assessing whether it is necessary is vital. This involves evaluating the current business situation, financial health, and future plans. Understanding the need for liquidation helps in making informed decisions and preparing for upcoming changes.

Creating a Strategic Plan

Remember to start by clearly stating your goals for the office liquidation. This could be to maximize the value of assets, minimize disruption to business operations, or ensure a smooth transition for employees. Clear goals and objectives help guide the liquidation process and measure its success. It’s important to set a timeline for the liquidation to ensure it is structured and efficient.

Establish realistic deadlines for each phase, from the initial assessment to the final closure. Milestones help track progress and ensure that all tasks are completed on time. This approach helps manage the process smoothly and reduces the risk of unexpected delays.

Legal and Regulatory Considerations

Make sure to follow all the relevant laws and rules to avoid fines and legal problems. Understanding and obeying local, state, and federal rules about getting rid of assets, managing employee changes, and following environmental guidelines. It’s important to have the right documents and to stick to these rules to have a smooth process for getting rid of assets.

Contractual Obligations

Review lease agreements and vendor contracts carefully. For lease agreements, understand the terms related to termination or transfer, negotiate with landlords, and manage notice periods to avoid penalties. For vendor contracts, identify obligations or penalties for early termination, and communicate with vendors to negotiate terms and ensure a smooth conclusion of services. Effective management of these contracts helps avoid unnecessary costs and ensures all parties are informed and prepared for the changes.

Asset Inventory and Assessment

Begin by thoroughly cataloging all office assets, including furniture, equipment, and technology infrastructure. Create a detailed inventory list that includes descriptions, quantities, conditions, and any relevant serial numbers or tags. This catalog serves as the foundation for evaluating the value of each asset. Maintaining a particular style in the inventory process ensures accuracy and ease of tracking.

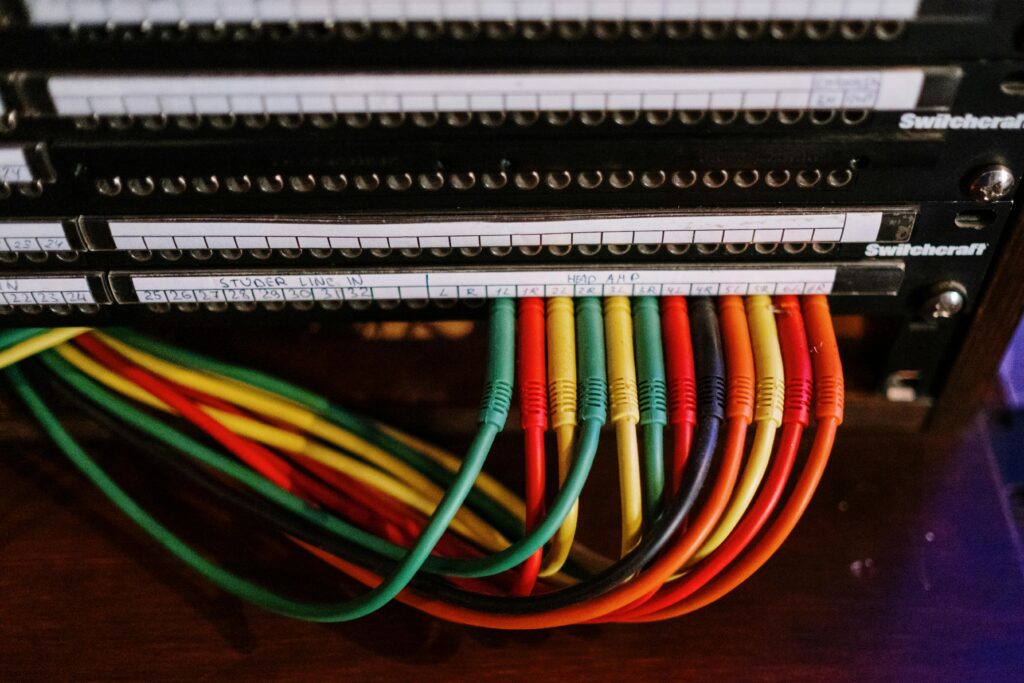

Once the assets are cataloged, assess their value based on current market conditions. Evaluate furniture and equipment for resale potential, considering factors such as age, condition, and demand. Similarly, assess the technology infrastructure, including computers, servers, and networking equipment, for their resale or repurposing value. Accurate valuation is crucial for maximizing financial recovery during the liquidation process.

Liquidation Methods

Choosing the right method for liquidating office assets is essential to maximize returns and minimize waste. Consider the following options:

- Selling Assets: Directly sell office assets to other businesses or individuals. Have you checked online marketplaces or reached out to local businesses interested in buying your equipment?

- Online Auctions: Utilize online auction platforms to reach a broader audience and potentially higher prices. Have you explored platforms like eBay or specialized auction sites for office equipment?

- Liquidation Companies: Partner with professional liquidation companies that specialize in office asset disposal. Do you know any reputable liquidation companies in your area?

Recycling and Disposal

For assets that cannot be sold or donated, implement environmentally responsible recycling and disposal methods. Have you contacted certified e-waste recyclers for your electronic equipment? Follow local regulations for disposing of non-recyclable items to minimize environmental impact and promote sustainability.

Managing Stakeholder Communication

Develop a clear internal communication strategy to keep employees informed about the timeline, expectations, and available support during the liquidation process. Externally, maintain transparent communication with clients and suppliers to manage their expectations and ensure a smooth transition. Clearly outline how services will be affected and provide contact points for any queries or concerns. This approach helps maintain trust and minimizes disruption for all stakeholders involved.

IT Infrastructure and Data Management

Ensure data security by encrypting, securely wiping, and sanitizing all data storage devices before disposal or resale. Implement clear protocols to protect data and comply with regulations. For IT system decommissioning, back up essential data, shut down systems methodically and dismantle hardware properly. Engage IT professionals to ensure secure and efficient processes, minimize data loss, and ensure appropriate equipment disposal or repurposing.

Financial Planning and Budgeting

Allocate a detailed budget for the entire office liquidation process. Consider costs such as legal fees, vendor payments, asset transportation, and disposal fees. Clearly define budget categories and allocate funds accordingly to ensure all aspects of the liquidation are covered, including any costs associated with vacating the office space.

Implement cost management strategies to keep the liquidation process within budget. Negotiate with vendors for better rates, seek competitive bids for services, and prioritize cost-effective methods for asset disposal. Regularly review expenses against the budget and adjust as necessary to avoid overspending.

Environmental Sustainability Initiatives

Implement green practices by responsibly disposing of e-waste, reusing materials, and choosing eco-friendly disposal methods. Partner with certified recycling companies for electronics like exIT Technologies and other recyclables. Reduce waste by donating or repurposing usable items, and sort materials for recycling, including electronics, paper, and office supplies. For example, donate used office furniture to local charities and recycle old computers through certified e-waste recyclers to minimize environmental impact.

Documentation and Record Keeping

Maintain comprehensive legal documentation, including contracts, compliance records, and agreements related to asset disposal. Keep detailed records of all asset dispositions, noting the condition, value, and final method for each item. For example, document the sale of office chairs, including their condition and sale price, and record the donation of old computers to a local school. Accurate records ensure transparency, legal compliance, and support future audits.

Post-Liquidation Evaluation

Evaluate the success of the office liquidation process by assessing key metrics such as the total revenue generated from asset sales, the efficiency of the process, and stakeholder satisfaction. Review how well the goals and objectives were met, including the effective disposal of work spaces, office desks, and quality furniture. Analyzing these metrics helps determine the liquidation’s overall effectiveness and identifies areas for improvement.

Learning from Challenges and Mistakes

Reflect on the challenges faced and mistakes made during the liquidation process. Identify what went wrong and why, and develop strategies to avoid similar issues in the future. For instance, if the disposal of office desks took longer than planned, analyze the reasons and adjust future timelines accordingly. Learning from these experiences strengthens the approach to future liquidations and enhances overall process efficiency.

Summary of Office Liquidation Process

Office liquidation involves several critical steps to ensure a seamless transition and optimization. Begin by understanding the need for liquidation and creating a strategic plan with clear goals and timelines. Ensure legal and regulatory compliance, manage contracts effectively, and catalog and assess asset value. Choose appropriate liquidation methods, communicate effectively with stakeholders, and manage IT infrastructure and data securely. Plan financially, implement green practices, and maintain thorough documentation.

A well-planned liquidation recovers financial investments through asset sales, ensures a smooth and efficient transition, and minimizes environmental impact through responsible disposal practices. Proper documentation and compliance with regulations protect against legal issues, and effective communication maintains trust with stakeholders. Ultimately, a successful liquidation process optimizes resources and sets a strong foundation for future business endeavors.