If you need to decommission and sell your IT hardware now, go to the bottom of this page or click this link to sell your IT equipment now.

Should you sell your computer(s), server(s), and other equipment now?

Over the past 15 years, certain categories of hardware have been disrupted in a variety of ways by significant breakthroughs and paradigm shifts.

These disruptions can significantly decrease the value of your IT equipment. As a result, having an understanding of market shifts as new releases hit the market can help you optimize your upgrade schedule.

Let’s dig in to the factors that determine when you should sell your IT equipment.

The Consumer Price Index As A B2B Hardware Barometer

The U.S. Bureau of Labor Statistics’ Consumer Price Index (CPI) tracks changes in predecessor prices for devices sold to household consumers — and this index often serves as an equally useful barometer for B2B hardware sales. According to the CPI, recent advances in laptop and desktop computer hardware, smartphones and smart home assistant devices have made all these categories of high relative importance for early-adopter consumers (and businesses).

Devices in the above categories have advanced especially quickly in terms of processing power — constituting an upward quality adjustment that drives predecessor prices sharply downward with each successive generation.

Here, we’ll take a closer look at the relative importance of these key categories, and examine how generational quality adjustment exerts a particularly strong impact on predecessor device pricing in each of them. We’ll then take a deeper dive into the category of storage hardware, and see how rapidly evolving approaches to data management have greatly disrupted the relative value of predecessor devices in this particular category.

Advances in processing power negatively impact predecessor device prices.

Optimization techniques such as hyper-threading and out-of-order instruction execution have greatly increased processors’ capabilities. A February 2020 MIT Technology Review article points out that the cost of fabricating a chip is increasing by 13 percent per year, and is expected to reach $16 billion or more by 2022.

Heat, power consumption, instruction-level parallelism and manufacturing constraints have all maintained a ceiling on the scale-up approach — shifting the hardware development roadmap from scale-up to scale-out.

Yesteryear’s pursuit of higher clock speed has given way to the pursuit of a higher number of cores per processor. From 2005 onward, the multi-core paradigm has increasingly defined expectations in the world of high-performance processor technology. Semiconductor technology has further enhanced the performance of multi-core processors — for example, the 14-nm Xeon processor integrates as many as 24 cores, supporting 3.07 TB of memory with 85 GB/s bandwidth.

All these processing advances have exerted a negative impact on the prices of previous generations of hardware. Generally when you’re deciding when to sell IT equipment, CPU upgrade schedules should be tighter than other components.

Predecessor price drops are particularly sharp in several related hardware categories.

The CPI tracks computers, peripherals, and smart home assistant devices as members of a single category, as changes in their prices are frequently interrelated. For example, processing power increases in laptops will negatively impact the prices not only of predecessor laptops but also of peripherals designed for maximum compatibility with that previous generation of laptops.

Speaker- and screen-based smart assistants, along with their accompanying accessories, use many of the same technologies and components found in computers. Touchscreen-based smart assistants, for instance, often use very similar hardware to that found in laptops, smartphones, and tablets. For this reason, the CPI also includes these devices in the same category as computers and peripherals.

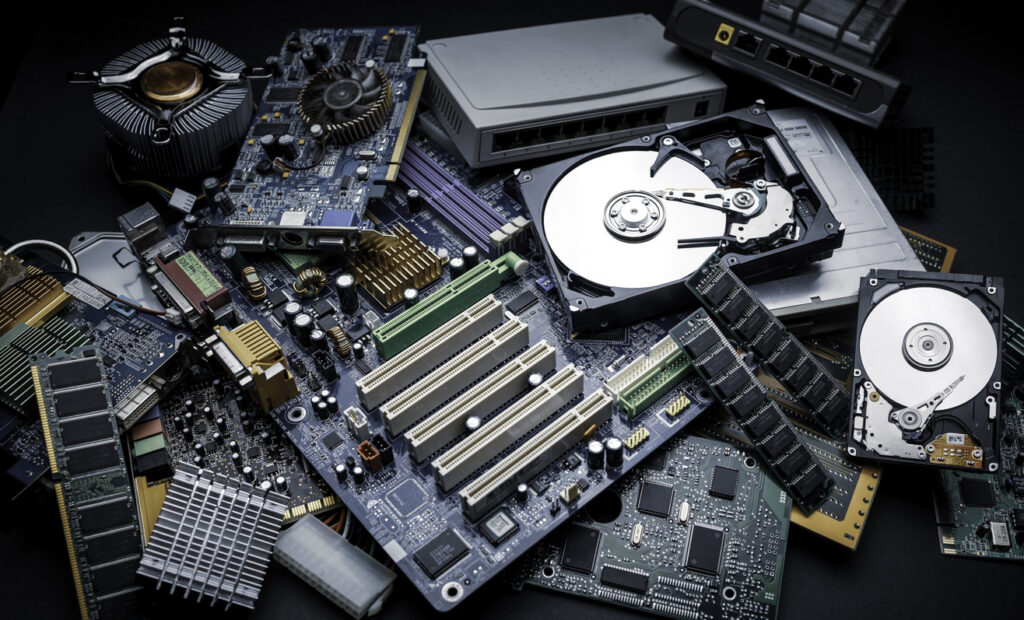

The CPI rates the relative generational quality adjustment for devices and components in this category according to certain attributes of the components that are used to build these devices. Particularly crucial components include the central processing unit (CPU), random access memory (RAM) chips and hard drives.

Computers, peripherals, and smart home assistant devices are especially hard-hit by advances, with prices typically undergoing a sharp drop every six months. RAM prices in particular are “falling through the floor,” with 16GB of DDR4-2133 selling for as little as $57 on Newegg.

For all these reasons, organizations can extract maximum ROI from their predecessor hardware by finalizing sales agreements before the beginning of a new six-month cycle (and the release of its corresponding processors) trigger a decrease in previous hardware’s market value.

New data management approaches are driving storage hardware’s value downward.

The single greatest transition in data management, over the past decade, has been the migration from on-premise to cloud storage. As more organizations transition to remote storage solutions for large volumes of data, traditional storage solutions such as on-premise servers have rapidly declined in value, with each generation delivering lower long-term ROI than the one before. A 2019 TechRepublic survey heralded “the death of the on-premise data center,” noting that only a quarter of IT professionals would give their companies’ storage infrastructure an “A” grade.

Meanwhile, the development of novel storage technologies has also exerted a significant impact on on-premise storage systems. As the performance gap between CPUs and storage devices continues to widen, 3-D stacking technologies and multi-core processors have increased cache support for parallel processors, fundamentally transforming existing storage hierarchies and opening up entirely new data management and analytics niches.

Due to the combined prevalence of cloud storage and multi-core processing, previous-generation storage hardware has become especially vulnerable to rapid value depreciation, with few devices maintaining a useful life of more than one year. While there’s no guaranteed way to counter-adapt to this depreciation, one rational approach is to offload predecessor storage hardware as soon as digital assets can be realistically migrated onto secure, cost-effective cloud platforms. So, in the case of storage hardware, the answer to the question “when to sell IT equipment?” is generally “yesterday.

Across all these areas, multiplying processing power has dovetailed with new storage paradigms to create an increasingly volatile marketplace for previous-generation hardware. As the value of predecessor devices continues to decrease at an accelerating rate, aftermarket vendors would do well to keep a close eye on the above market factors, and equip their IT departments to act on emerging opportunities as soon as they become apparent.